SEPA (Single Euro Payments Area) and SEPA Instant are key electronic payment systems used across the Eurozone, designed to streamline transactions in euros. While SEPA allows individuals and businesses to make domestic and cross-border payments using a single bank account, SEPA Instant, an extension of SEPA, enables real-time, 24/7 payment processing.

SEPA: Simplifying Cross-border Payments

Introduced in 2008, SEPA aims to harmonize euro payments across Europe, covering 36 countries, including EU and EEA members, as well as some non-EU nations like Switzerland. It allows seamless domestic and cross-border payments in euros from a single account.

Processing Time

SEPA payments are typically processed in 1-3 business days. The delay stems from the involvement of multiple intermediaries, including both the sender’s and the recipient’s banks. While SEPA is reliable and cost-effective, it may not be ideal for time-sensitive transactions.

Availability

SEPA payments operate during regular banking hours, Monday to Friday, excluding public holidays. Payment cut-off times can vary by bank, so it’s important to check deadlines with your financial institution.

Regulatory Requirements

SEPA payments use the International Bank Account Number (IBAN) and Business Identifier Code (BIC) to ensure transaction accuracy and security. These standards, along with national regulations, help streamline payments within the SEPA network.

SEPA Instant: Instant Payments for the Digital Age

SEPA Instant, launched in 2017, builds on the SEPA framework by offering real-time payment processing. With SEPA Instant, funds are transferred instantly, 24/7, 365 days a year, within the SEPA region, offering a significant advantage for time-sensitive transactions.

Processing Time

Unlike SEPA, SEPA Instant payments are completed in real-time, typically within 10 seconds. This is particularly valuable for urgent payments, such as immediate bill payments or online purchases, where swift processing is essential.

Availability

SEPA Instant is available at any time, even on weekends and holidays. This round-the-clock service enhances convenience for both businesses and consumers, enabling seamless payment experiences no matter the time.

Regulatory Requirements

SEPA Instant follows similar regulatory protocols as SEPA, requiring IBAN and BIC codes for transaction security. However, the instantaneous nature of SEPA Instant often means stricter security protocols are implemented by financial institutions to protect against fraud.

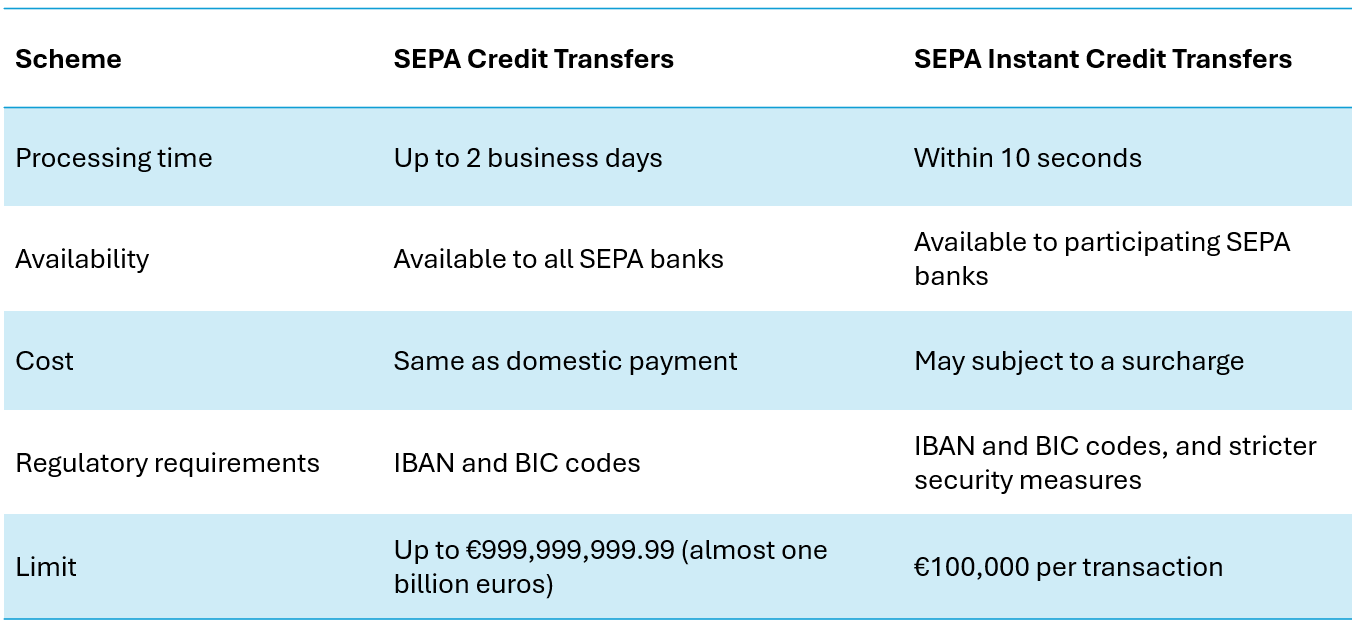

Key Differences Between SEPA and SEPA Instant

Processing Time

SEPA: 1-3 business days

SEPA Instant: Processed within 10 seconds

Availability

SEPA: Available during standard banking hours, excluding holidays

SEPA Instant: Available 24/7, including weekends and public holidays

Cost

SEPA and SEPA Instant generally have similar costs to domestic payments. However, some banks may charge extra for SEPA Instant payments. It’s important to verify with your bank.

Security and Regulatory Measures

Both require IBAN and BIC codes. SEPA Instant, due to its real-time nature, may involve additional security checks by banks.

Use Cases

Both SEPA and SEPA Instant are versatile and can be used for various transactions, each with its ideal scenarios:

-

Bill Payments

-

SEPA: Ideal for regular, non-urgent bills (e.g., utility payments).

-

SEPA Instant: Best for urgent bill payments, like overdue credit card bills.

-

-

Money Transfers to Friends and Family

-

SEPA: Suitable for non-urgent transfers (e.g., reimbursing for dinner).

-

SEPA Instant: Perfect for emergency transfers (e.g., sending money for medical expenses).

-

-

Online Purchases

-

SEPA: Good for non-time-sensitive purchases (e.g., clothing or books).

-

SEPA Instant: Excellent for time-critical purchases (e.g., concert tickets or event booking).

-

-

In-store Payments

-

SEPA: Useful for routine purchases (e.g., groceries or clothing).

-

SEPA Instant: Ideal for quick, small purchases (e.g., coffee or a sandwich).

-

-

Splitting Expenses

-

SEPA: Great for non-urgent splits (e.g., shared grocery bills).

-

SEPA Instant: Better for urgent expense splitting (e.g., taxi fares or shared travel costs).

Conclusion

SEPA and SEPA Instant serve different needs in the world of digital payments. SEPA is a reliable option for non-urgent payments, offering efficiency and low costs. In contrast, SEPA Instant provides the speed and flexibility required for time-sensitive transactions, available around the clock. When choosing between the two, consider the urgency and nature of your payments to determine which system is right for you.